Learn how to add PayPal as a payment method in Shopify with this step-by-step guide from doola!

Offering multiple payment options is now baseline in e-commerce because buyers expect flexibility, faster checkout, and minimal friction across their purchase journey.

Adding card, wallet, and BNPL options lets shoppers use saved payment details and complete authentication inside the wallet itself. This shortens checkout (fewer fields and redirects), reduces drop-offs, and increases the rate of completed orders.

With that context, PayPal adds both scale and safeguards.

On scale: in 2024, PayPal reported 434 million active consumer and merchant accounts across 200+ countries/regions with 25 supported currencies, which means you can sell cross-border without building country-by-country payment rails.

On safeguards: the PayPal wallet speeds checkout with saved details. Plus, Buyer/Seller Protection (eligible transactions) and the Resolution Center provide a clear dispute path; and security controls such as 2FA and risk screening help prevent unauthorized activity.

Put simply, these capabilities make PayPal a high-impact payment method for Shopify.

The integration does have nuances, though. But don’t worry.

This guide shows you how to add PayPal as a payment method in Shopify, step by step.

In addition, we’ve explained multi-currency behavior, covered security and reconciliation, and outlined troubleshooting for the issues merchants encounter most.

Ready? Let’s get started.

Why Add PayPal as a Payment Method?

Here are a few benefits of adding PayPal as a payment method:

Higher Checkout Conversion

A Nielsen study (commissioned by PayPal) found large enterprises offering PayPal saw ~33% higher checkout conversion on average. And Baymard’s 2024 data shows 13% of shoppers abandon when their preferred payment method isn’t offered, and 22% abandon when checkout is too long/complex.

PayPal directly addresses both by giving shoppers a trusted wallet at cart/checkout that auto-fills saved shipping/billing and pays in a few clicks.

| Did You Know? Express Checkout is now branded PayPal Checkout. The core difference is the checkout experience: PayPal Checkout is optimized to keep buyers “in context” and reduce friction, while Website Payments Standard is a simpler, legacy redirect/button flow. PayPal Express (PayPal Checkout) vs. PayPal Payments Standard Note: On Shopify, the built-in PayPal integration aligns with PayPal Express/Checkout for the best on-site experience; Standard is generally considered a legacy/quick-add option. |

Broader Market Reach

Like we mentioned earlier, PayPal operates at global scale with many active consumer + merchant accounts across ~200 markets, giving you immediate access to customers who already trust and use the wallet.

Built-in Reassurance

PayPal Purchase Protection, available for eligible transactions, offers buyers a safety net if their order doesn’t arrive or isn’t as described.

This feature increases buyer confidence, which can lead to higher conversion rates, particularly for international sales and purchases from new brands.

PayPal’s Built-In Dispute Tool (Resolution Center)

PayPal centralizes disputes, claims, and chargebacks in the Resolution Center, giving you a structured workflow to respond, upload evidence, and track outcomes. Common case types include Item Not Received (INR) and Significantly Not as Described (SNAD).

A buyer can open a dispute and has a limited window to escalate it to a claim that PayPal adjudicates.

Prerequisites for PayPal Integration

Before you enable PayPal, review the prerequisites below, separate lists for Individuals/Sole Proprietors and Registered Businesses.

For Registered Businesses (LLC/LLP/Private Ltd/C-Corp)

- Paid Shopify plan with Online Store checkout. You need a live, secure checkout for PayPal to appear.

- Store legal details set (name, address, country, phone). PayPal checks these for risk and country eligibility.

- Primary store currency chosen (PayPal-supported). Ensures totals/settlement work without weird conversions.

- Taxes configured (VAT/GST/etc.)

- Shipping zones & rates added. Checkout needs a shipping cost before PayPal can calculate the final amount.

- Policies published (Refund, Privacy, Terms, Shipping). PayPal and customers rely on these during disputes.

- SSL/HTTPS active on your domain. Mandatory for secure payments and trust.

- Payment capture mode decided (auto/manual). Defines how PayPal authorizations become captured funds.

- No duplicate/legacy PayPal methods enabled. Prevents double buttons and failed handoffs.

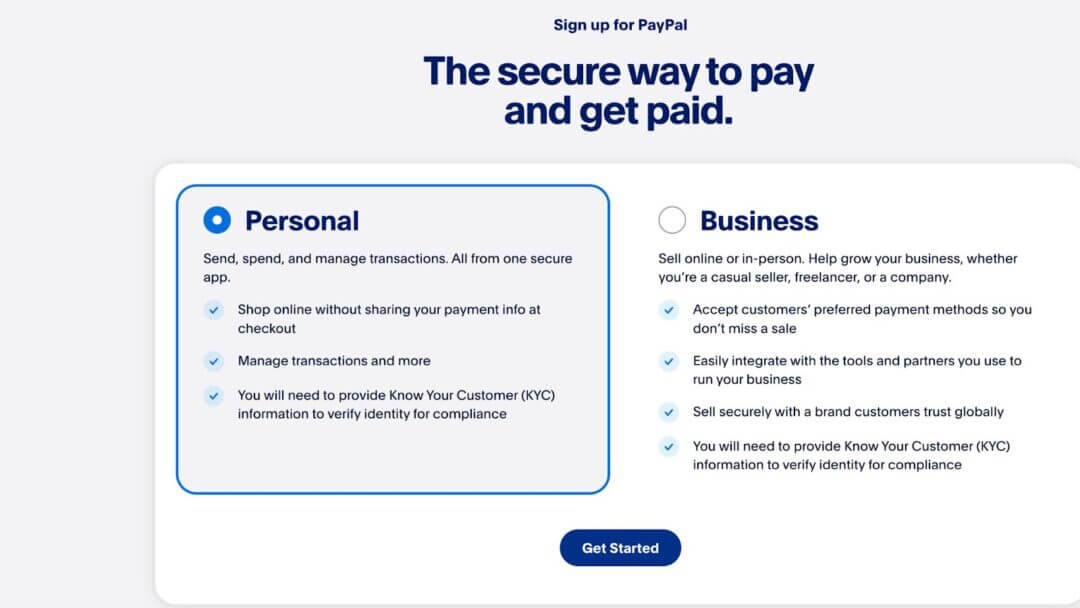

- PayPal Business account (entity = company). Only Business accounts can legally process e-commerce at scale.

- Email verified. Unverified emails block payouts and trigger limits.

- Business verification (KYC) completed, required by regulation; missing docs lead to holds/reserves.

- Ultimate Beneficial Owner details submitted, needed for compliance (AML/KYC) on corporate accounts.

- Bank account linked & confirmed (in business name). Enables withdrawals, refunds, and chargeback debits.

- Card added as backup funding source, covers instant refunds or negative balances.

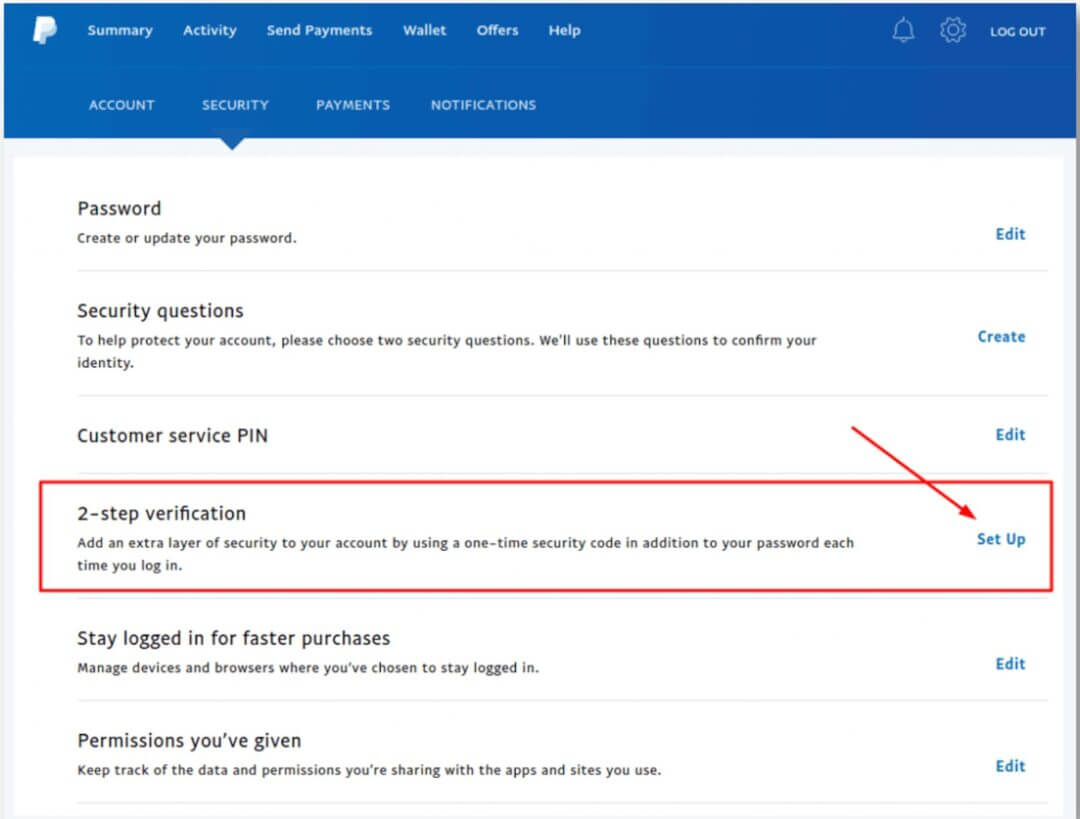

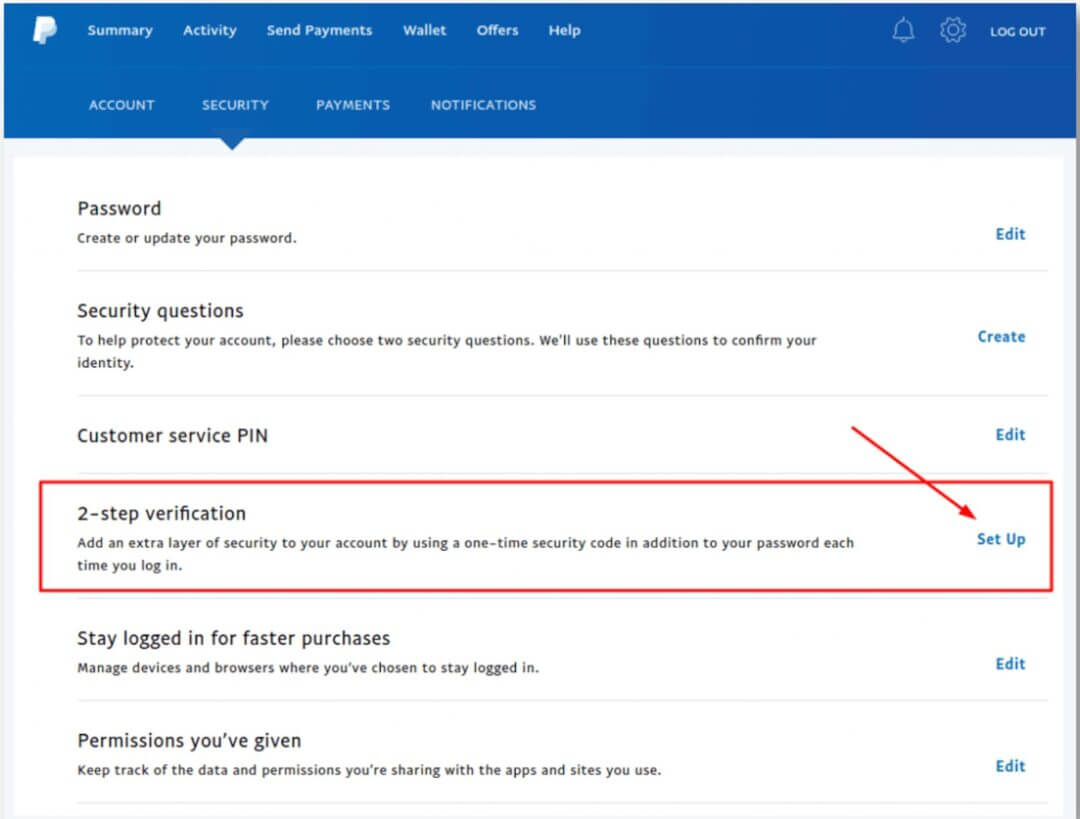

- Two-factor authentication (2FA) enabled. Protects account access and may be required for some actions.

- Business category (MCC) + product descriptions set, helps PayPal assess risk and show the right checkout options.

- Acceptable Use compliance check, prohibited items/services can get you limited or banned.

- Country & currency eligibility confirmed, ensures you can receive in your target currency/markets.

- Tax IDs on file (EIN/GSTIN/VAT, as applicable), needed for reporting, invoicing, and higher limits.

- Dispute & refund SOP documented. Faster responses reduce chargebacks and account risk.

- Basic fraud review process.

- Accounting reconciliation workflow to map Shopify orders vs PayPal fees for clean books.

- Live test order + refund for validating end-to-end flow, settlement, and notifications before scale.

- (Optional) PayPal API credentials, only if you’ll use custom apps; not needed for native Shopify PayPal.

For Individuals / Sole Proprietors (No Incorporated Company)

Heads-up: even as an individual, Shopify requires a PayPal Business account. Set the business type to “Sole Proprietor/Individual.”

- Paid Shopify plan with Online Store checkout. PayPal won’t show on paused/trial checkouts.

- Store details using your legal name + trading name to keep invoices, policies, and KYC consistent.

- Primary store currency chosen (PayPal-supported) to avoid broken pricing or forced conversions.

- Taxes configured (where you sell), makes totals accurate and compliant at checkout.

- Shipping zones & rates added.

- Policies published (Refund, Privacy, Terms, Shipping). This builds trust and protects you in disputes.

- SSL/HTTPS active is required for secure payment flows.

- Payment capture mode decided (auto/manual), defines how your PayPal authorizations settle.

- No duplicate/legacy PayPal methods.

- PayPal Business account (type = Sole Proprietor), enables ecommerce receiving, reporting, and dispute tools.

- Email verified. Without it, payouts and limits get stuck.

- Identity verification (KYC) done. Government ID + address proof needed to lift limits and avoid holds.

- Bank account linked & confirmed (in your name), lets you withdraw funds and process refunds/chargebacks.

- Card added as backup, covers instant refunds and negative balances.

- Two-factor authentication (2FA), protects your earnings from account takeovers.

- Business category + product descriptions.

- Acceptable Use compliance check to ensure your products/services are allowed.

- Country & currency eligibility confirmed, some countries/currencies have receive/settlement limits.

- Tax IDs on file (PAN/TIN/VAT/GST, as applicable), required for reporting and higher limits.

- Simple dispute & refund SOP

- Basic fraud checks. Watch for mismatched shipping, odd IPs, and sudden AOV spikes.

- Basic bookkeeping for PayPal fees. Track net vs gross so margins stay real.

- Live test order + refund for sanity-check payments, emails, and settlements before you go wide.

Steps to Link a Bank/Credit Card to PayPal

In this section, you’ll learn how to (1) link a bank account to PayPal so you can withdraw money and fund refunds, and (2) add a debit/credit card as a backup funding source.

We’ve included steps for both desktop (web) and the PayPal mobile app. Each step says what to click and what the screen means.

A) Link a bank account to PayPal (desktop web)

✔️ Sign in to PayPal and open your Wallet by visiting paypal.com. Next, click the “Log In” button, and enter your email and password.

After signing in, you will be directed to your account dashboard where you can access your Wallet by clicking on the Wallet tab or icon (sometimes labeled Banks & Cards).

✔️ Select Link a card or bank, then choose Link a bank account.

✔️ Pick your bank from the list. If you see an instant login option, use it to confirm ownership inside your bank’s secure page.

If you don’t see that option, choose manual entry and type your account holder name, account number, and the routing/IFSC/sort code your country uses. Use the legal name exactly as it appears on the bank.

✔️ Select Agree and link to add the bank.

✔️ If you use manual entry, PayPal sends two small deposits to your bank within a few business days. Check your statement, note the exact amounts, return to Wallet, open the bank you added, and enter those two amounts to confirm the bank. This proves the account is yours.

✔️ If you have multiple banks, choose the one you just confirmed and set it as your primary withdrawal method so payouts and refunds draw from the right place.

Notes for help:

- If your statement shows one combined line instead of two separate deposits, wait a bit or try the resend option in Wallet; some banks merge small deposits.

- A name mismatch between PayPal and your bank is a common reason for failure, so make sure you match the spelling carefully.

- In some countries (e.g., India), you may also need to set a purpose code before withdrawals work; look for that prompt in your account settings.

B) Link a bank account to PayPal (mobile app)

✔️ Open the PayPal app and go to Wallet (sometimes labeled Banks & Cards).

✔️ Tap Add or the plus button, then choose Bank.

✔️ Search for your bank. If instant login is offered, complete it; otherwise, enter your account holder name, account number, and the routing/IFSC/sort code, then finish the on-screen steps.

✔️ If you added the bank manually, watch for two small deposits and confirm them in the app to complete verification.

✔️ Set this bank as your preferred withdrawal method if the app shows that option.

C) Add a debit or credit card to PayPal (desktop web)

✔️ In Wallet, select Link, a debit or credit card.

✔️ Enter the card number, expiry, CVV, and billing address. The billing address must match what your card issuer has on file.

✔️ Complete any 3-D Secure or one-time passcode step your bank requires. This prevents unauthorized use.

✔️ PayPal may place a small temporary charge to verify the card. It falls off automatically.

✔️ Keep this card on file as a backup funding source for instant refunds or if your PayPal balance is negative.

D) Add a debit or credit card to PayPal (mobile app)

✔️ In the app, open Wallet (or Banks & Cards) and tap Add.

✔️ Choose Debit or Credit Card. You can type the details or use your phone camera to scan the card.

✔️ Enter the card number, expiry, CVV, and billing address, then complete any bank verification screen that appears.

✔️ The card is now available for payments and as a backup for refunds/negative balances.

| PayPal + Shopify Payments: Multi-Currency Rules 👉🏼 Multi-currency with PayPal only “just works” if you also use Shopify Payments. If Shopify Payments is enabled and you sell in multiple currencies, PayPal will present/ refund in the shopper’s currency. Without Shopify Payments, PayPal checkouts default to your store currency (and PayPal may convert later). 👉🏼 PayPal supports ~25 currencies, but a few have “in-country only” rules.BRL, CNY, MYR can be held/settled only by PayPal accounts in those countries; otherwise PayPal auto-converts to your primary currency (with a spread/fee). Also note zero-decimal currencies (e.g., JPY, HUF, TWD). 👉🏼 Expect conversion on the PayPal side if needed. If a shopper pays in a currency you don’t hold (or one of those restricted currencies), PayPal converts to your balance currency using its own rate (includes a fee). 👉🏼 “Pay Later” options are country-specific. PayPal Credit/Pay in 4, Venmo, etc., are offered only in selected markets (e.g., Pay Later is available in the US, UK, DE, FR, IT, ES, AU; Venmo is US-only). |

| Quick Troubleshooting Tips 💡 Can’t add bank/card? Double-check the name and billing address match your bank or card records exactly. 💡 No micro-deposits yet? Give it up to a few business days, then use the resend option in Wallet. 💡 3-D Secure fails? Try again on a different network/browser or via the app; some banks block pop-ups. |

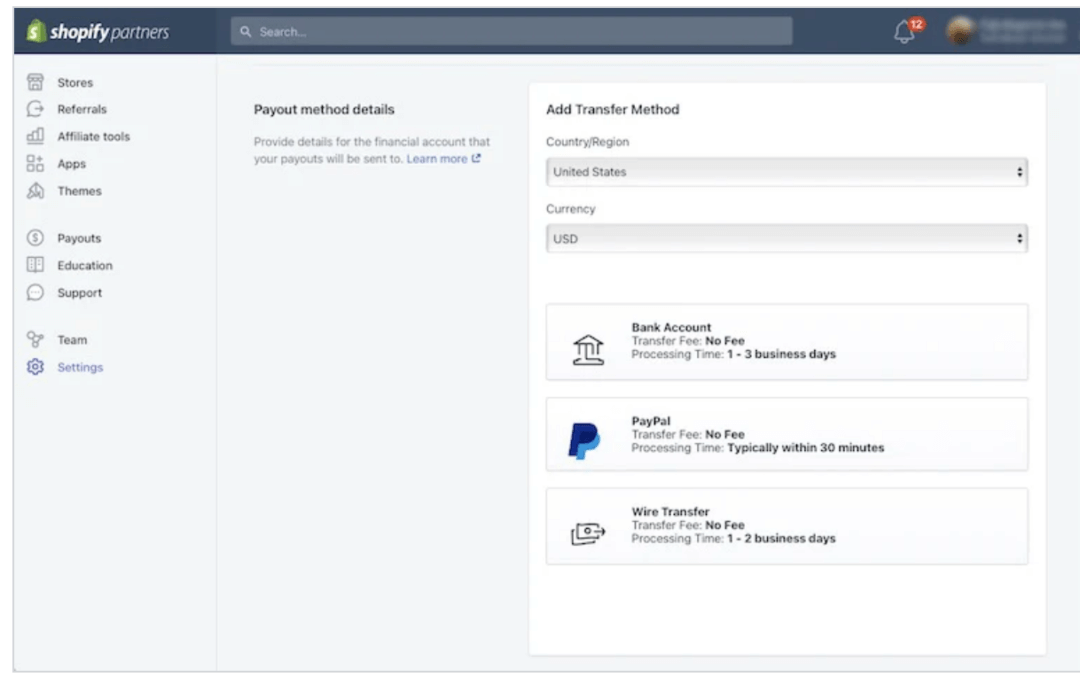

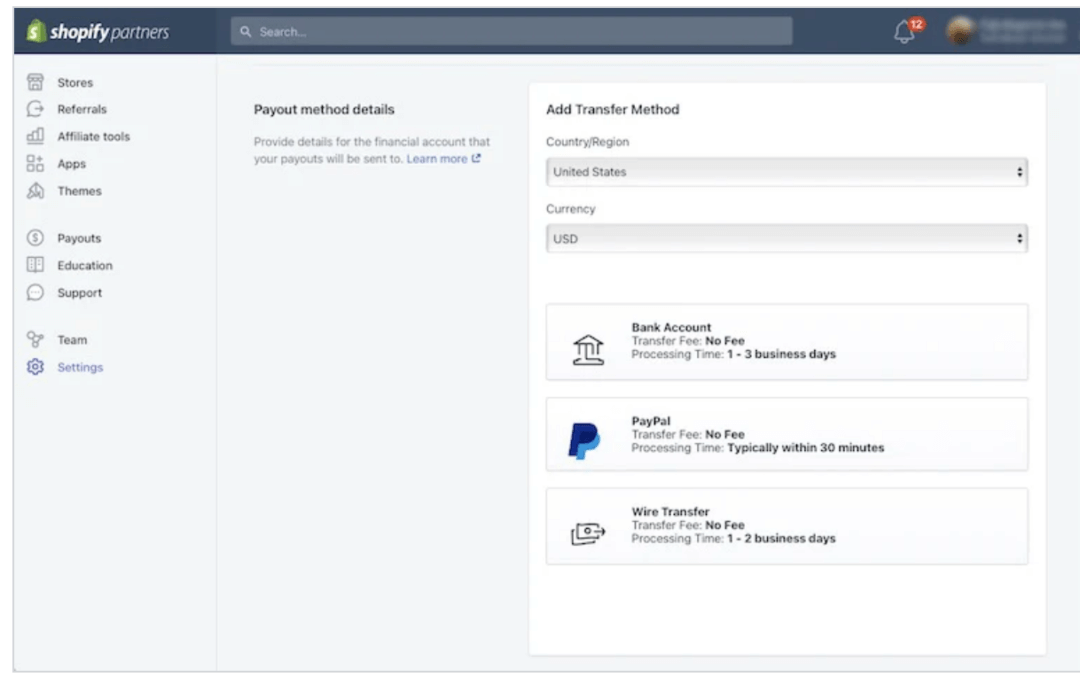

Step-by-Step: How to Add PayPal as a Payment Method in Shopify

Here’s how to integrate PayPal into your Shopify store.

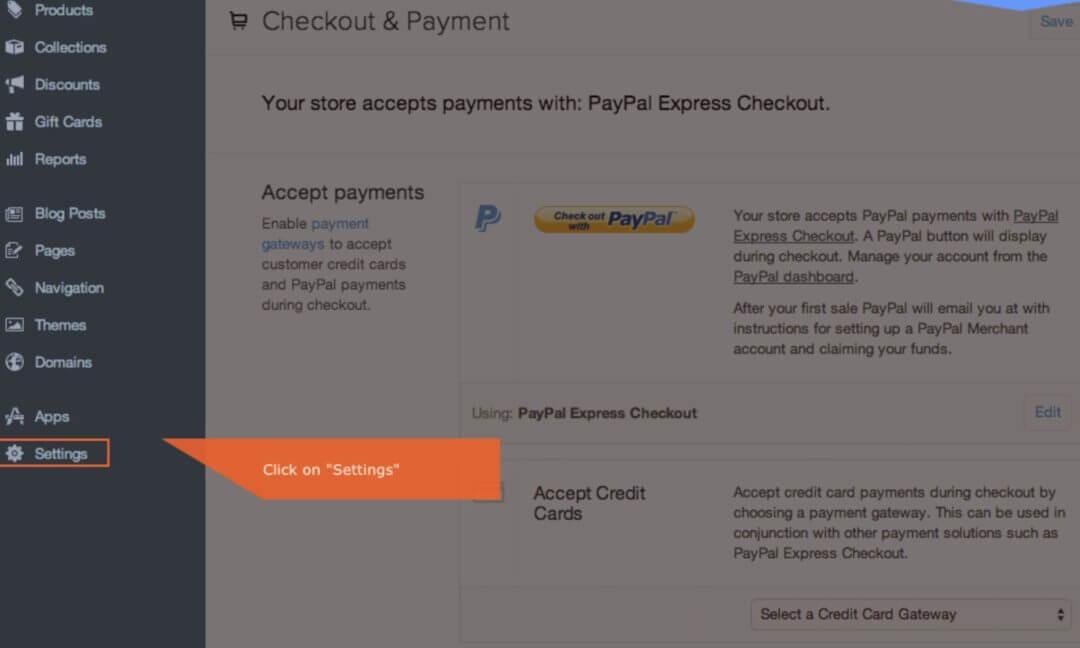

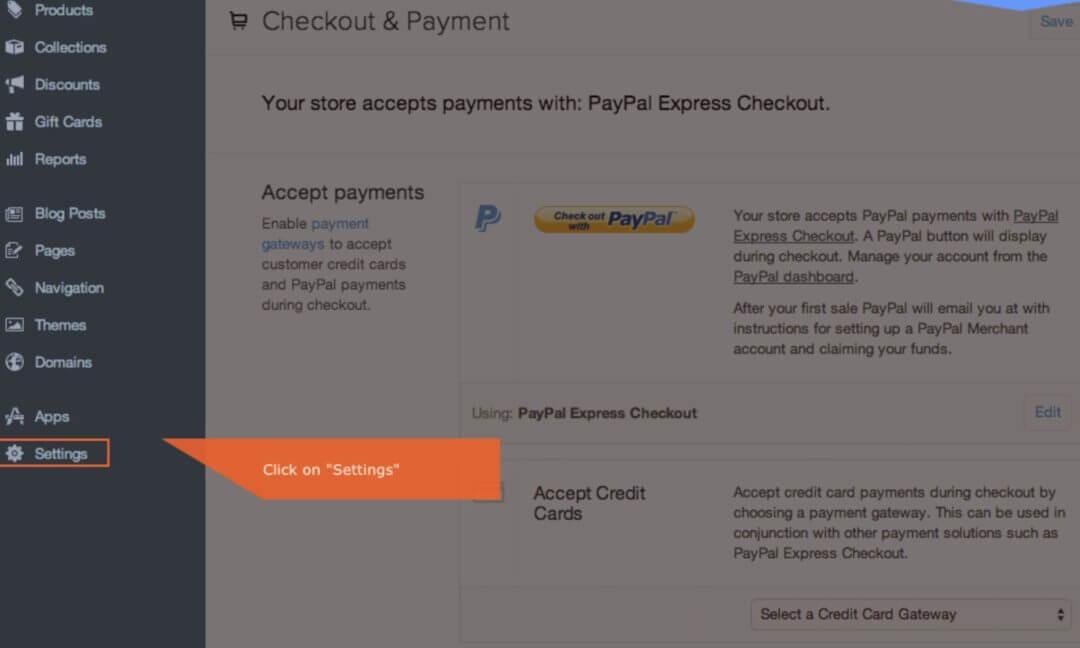

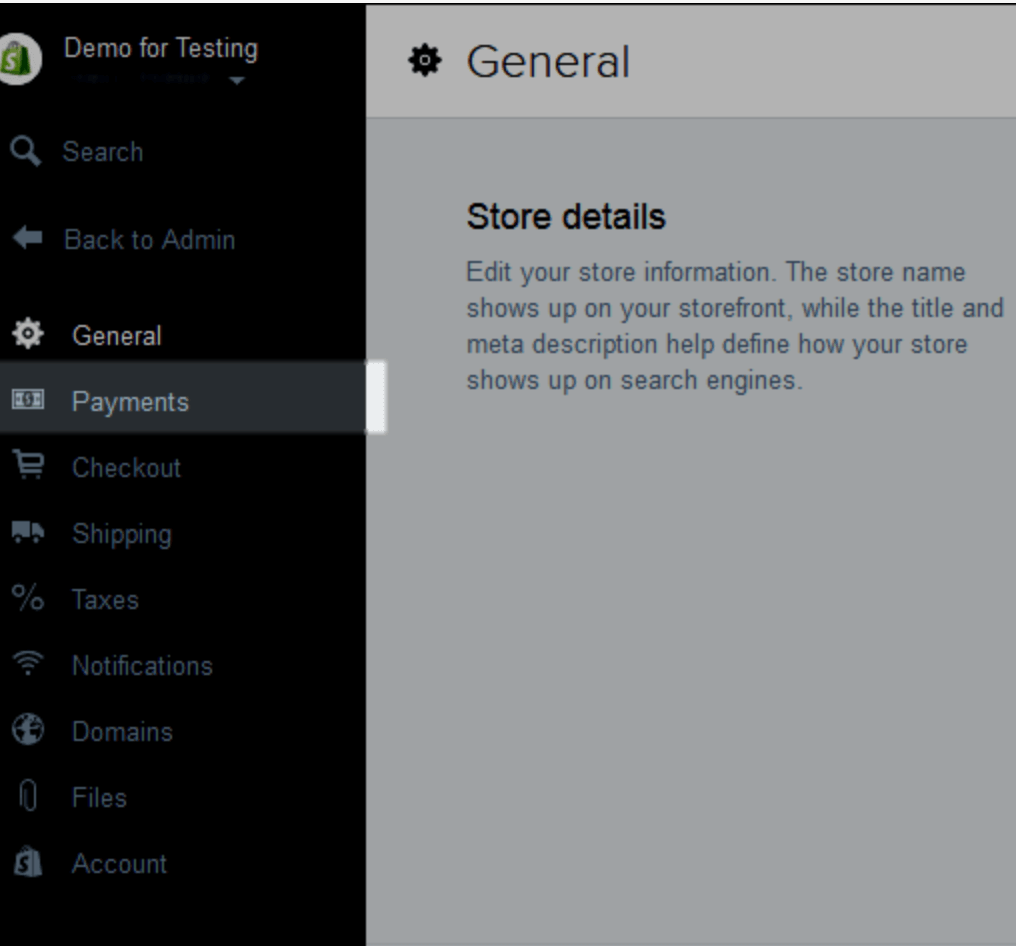

Step 1: After Signing In to Your Shopify Admin, Open Settings From the Left-Hand Menu.

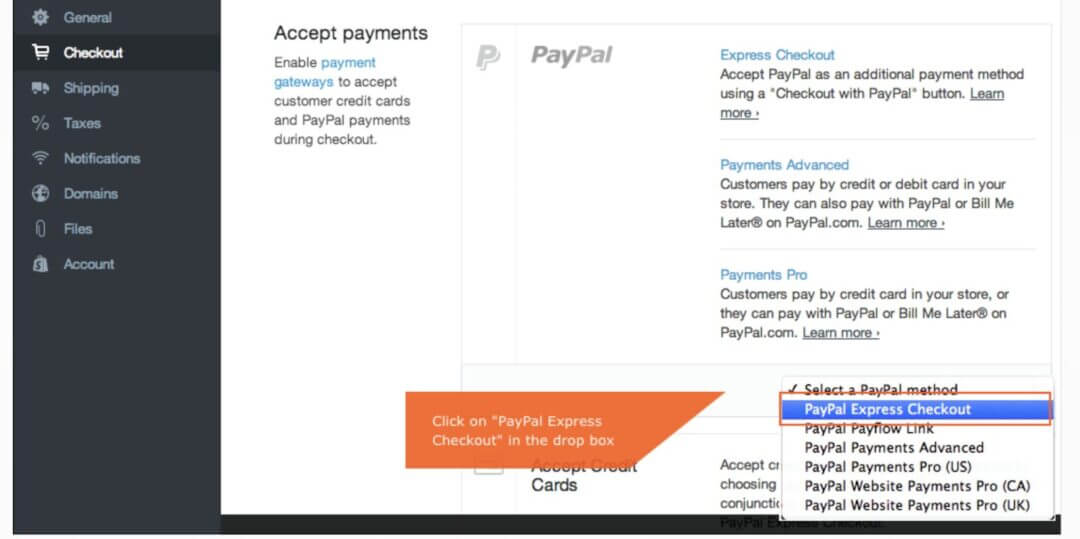

Step 2: Next, Click on Payments.

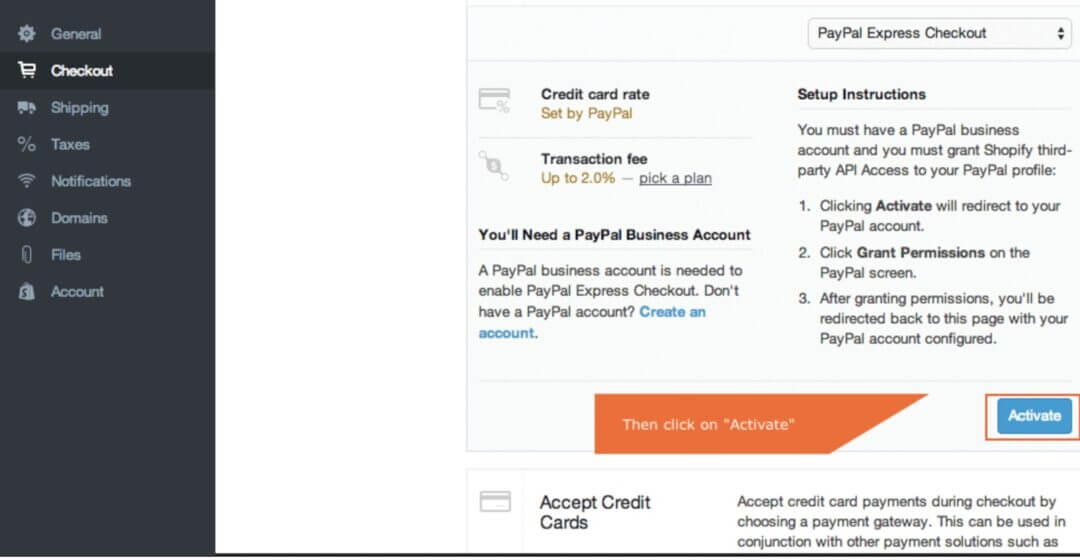

Step 3: Under PayPal, Select PayPal Express Checkout in the Dropdown.

Step 4: Click Activate

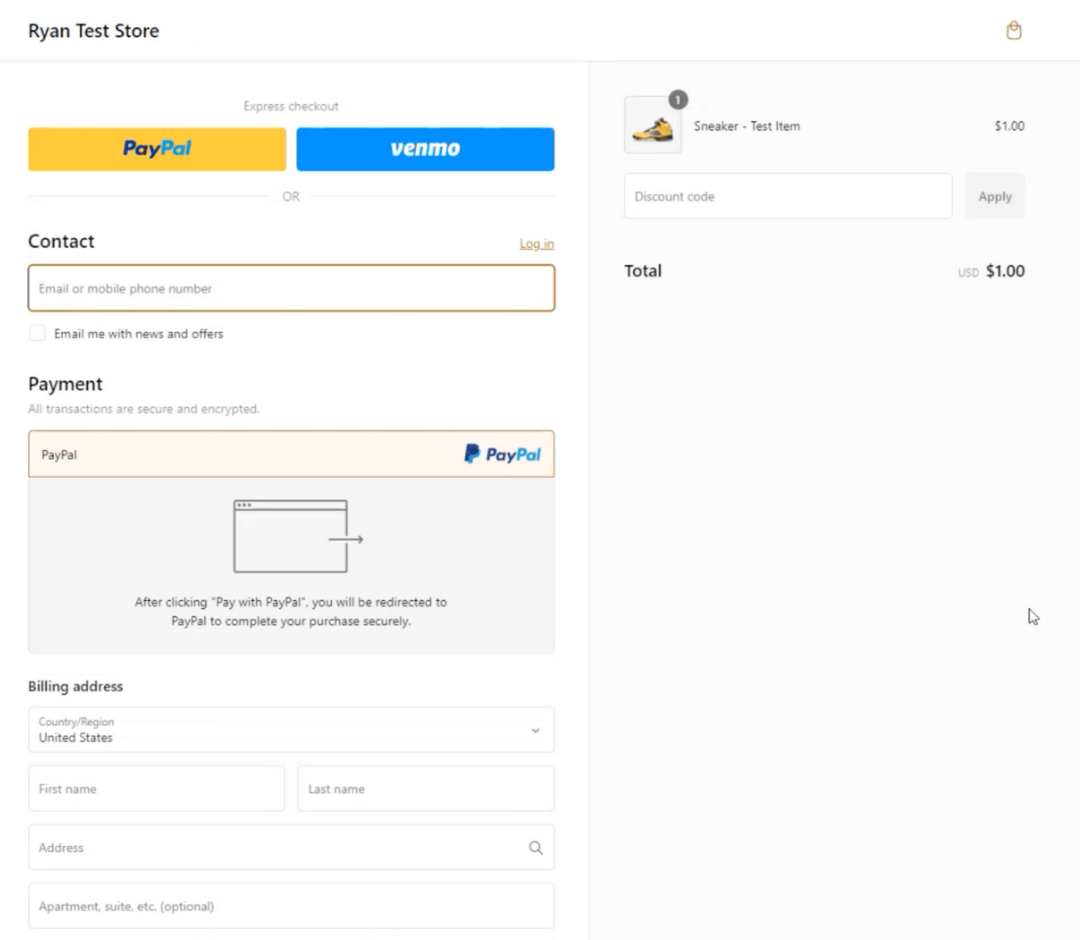

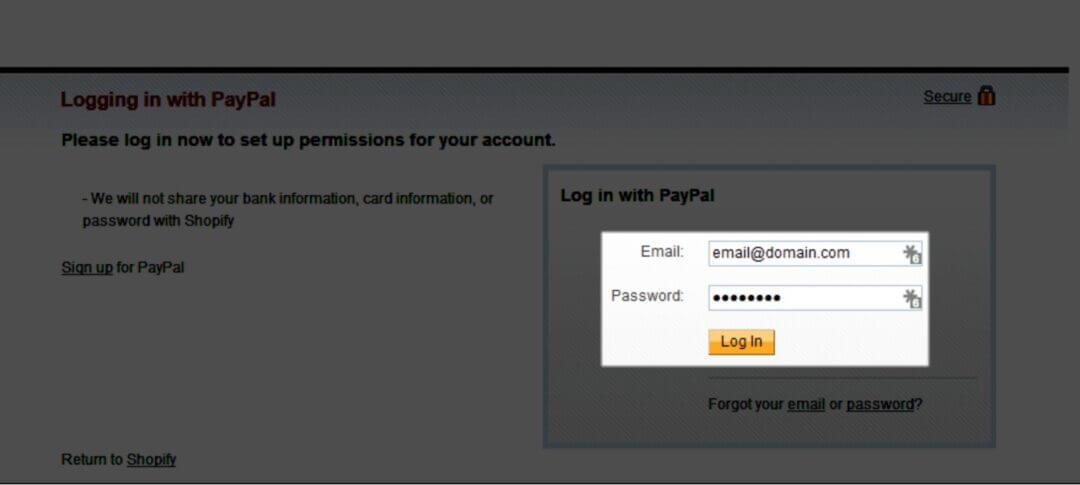

Step 5: You’re Redirected to PayPal; Log In to Your Account to Authorize the Connection

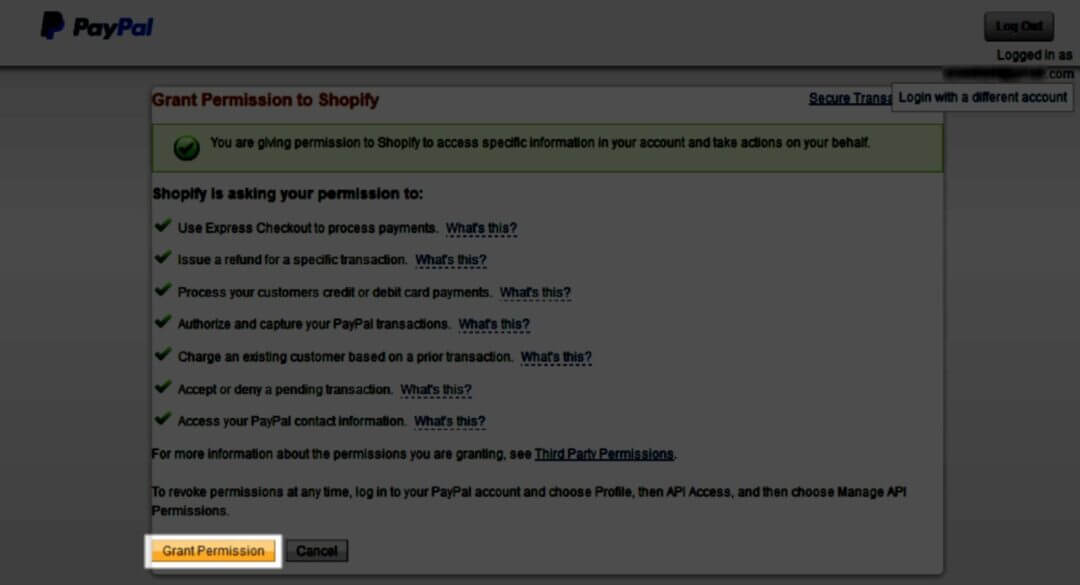

Step 6: Click Grant Permission

Step 7: You’ll Be Redirected to Shopify Admin. Click Save to Complete Setup.

| What happens after the customer clicks “PayPal” at checkout?

The buyer either logs in to a PayPal account (to use a saved card/bank) or pays without logging in by entering card details on a PayPal-hosted page (guest checkout). After the payment step finishes, PayPal sends the buyer back to your store’s order status/thank-you page. Shopify receives a confirmation with the payment status (authorized or captured), transaction ID, and the shipping address from PayPal (if provided), so the order can be marked paid/authorized and post-purchase emails can go out. “Check out as guests”availability depends on the country, buyer risk checks, and PayPal’s policies. In some regions or scenarios, PayPal may not show guest checkout or may nudge the buyer to create an account. |

After You Connect PayPal in Shopify: What To Do Next

1) Set Up Shipping And Delivery (So Checkout Can Calculate Totals)

From Shopify Admin, open Settings → Shipping and delivery.

Create shipping zones (countries/regions you ship to) and add rates (flat, weight-based, price-based, or carrier-calculated). If you use carrier rates (UPS/FedEx, etc.), activate third-party calculated shipping and connect your carrier accounts.

Test a cart to confirm the right rate shows for each zone and service level.

2) Add/Confirm Your Shopify Billing Method (For Shopify’s Own Fees)

This is for paying Shopify’s subscription and app charges, not your customers’ payments. In Shopify Admin, go to Settings → Billing → Billing profile → Add payment method and add a valid card (or PayPal where available).

3) Enable PayPal Guest Checkout (Where Eligible)

Guest checkout lets customers pay by card without logging into a PayPal account.

Turn on PayPal account optional in your PayPal Business account: Account Settings → Website payments → Website preferences → PayPal account optional = On.

Availability depends on country and PayPal risk checks, so test a real checkout after enabling.

4) Sanity Test The Flow

Place a low-value order and confirm: the PayPal button appears in Cart/Checkout, shipping rates apply correctly, the order returns to your thank-you page as Paid/Authorized (based on your capture setting), and guest checkout appears if eligible.

If PayPal isn’t visible, complete PayPal setup in Settings → Payments and ensure only one PayPal method is active.

Merchant FAQ: PayPal–Shopify Connection

These are the questions doola hears most often from Shopify merchants during payments audits. To save you the back-and-forth, we’ve pulled them into one place, with clear answers and exact next steps.

You’ll find what to check when PayPal is missing at checkout, what it means when a payment fails or stays pending, how to match PayPal payouts to Shopify orders for clean books, and a step-by-step on disputes, refunds, and chargebacks.

| Why Is PayPal Missing From Checkout, And What Should You Check? ✔️ Activation: In Shopify Admin → Settings → Payments, confirm the PayPal section shows a connected Business account. If you see legacy/duplicate PayPal methods, remove them and keep only the current PayPal option active. ✔️ Account readiness: In the PayPal dashboard → Settings/Account, verify the primary email, complete Business/KYC, and ensure the PayPal account country matches your Shopify store country. ✔️ Currency support: Use a PayPal-supported store currency. For multi-currency storefronts, enable Shopify Payments so PayPal can present/refund in the shopper’s currency where supported; otherwise PayPal may convert at its own rate. ✔️ Theme/app conflicts: If buttons are missing or duplicated, temporarily disable dynamic checkout on complex product pages (bundles/configurators) and surface PayPal in Cart and Checkout only. ✔️ Guest payments availability: “Pay with card” via PayPal depends on region and risk checks. If it is not appearing, ensure your PayPal Business settings allow guest checkout where eligible, then test a live transaction. What Happens If PayPal Payments Fail Or Stay Pending? ⚠️ Pending (Authorized, Not Captured): Your store is on manual capture or a split shipment. Capture the payment on the order (full or partial) before the authorization window expires; if it does expire, the buyer must repay. ⚠️ Pending (Account/Risk Hold): New accounts, incomplete KYC, or elevated dispute/refund rates can trigger temporary holds. Complete KYC, ship with tracked delivery (signature above your AOV threshold), and keep a small PayPal balance or a backup card to fund refunds. ⚠️ Failure At Checkout: Provide an alternate path (direct card via Shopify Payments). Ask the buyer to retry with the PayPal wallet or another device/browser. Confirm guest card payments are allowed in your PayPal settings where supported. How Do You Reconcile PayPal Payouts With Shopify Orders? 👉🏼 Bridge the numbers: Gross PayPal Sales − PayPal Fees − Refunds − Chargebacks/Adjustments ± FX = Net Deposits to Bank (for the same period). 👉🏼 Evidence pack: Save: (1) Shopify orders paid by PayPal, (2) PayPal activity/payout report, and (3) bank statement. Produce a one-page Gross → Net → Bank bridge and investigate any material variance. 👉🏼 GL hygiene: Use a PayPal Clearing account (asset). Book PayPal fees to payment processing expense (not COGS). Lock closed months and post any corrections as dated adjustments. How Should You Handle Disputes, Refunds, And Chargebacks? ✔️ Ship only to the PayPal transaction address. ✔️ Add tracking the day you fulfill (signature above a defined AOV). ✔️ Keep pack-out photos/serials for high-value items. ✔️ Align policy wording (Refund/Shipping/Terms) with support macros. Refunds ✔️ From the Shopify order (or in PayPal), issue a full or partial refund. ✔️ Ensure a linked bank or backup card in PayPal so refunds clear immediately. ✔️ Update inventory and send the customer a confirmation. Disputes (PayPal Resolution Center) 👉🏼 Item Not Received : Provide carrier tracking showing delivery to the PayPal address (signature if applicable). 👉🏼 Significantly Not As Described (SNAD): Provide product photos, listing copy, correspondence, and return instructions (if you accept returns). 👉🏼 Respond within the stated timeline inside the Resolution Center so all evidence sits in one record. Chargebacks (Card Network Via PayPal) 👉🏼 Submit the same evidence package (tracking/signature, product proof, policies). 👉🏼 Monitor outcomes; if patterns emerge (e.g., INR in a country/sku), raise signature thresholds or adjust risk rules. After Resolution 👉🏼 Record the result in your dispute log and reconcile any debits/credits via the PayPal Clearing account. 👉🏼 Update SOPs if a gap was identified (e.g., missing tracking, unclear policy). |

PayPal + Shopify: Troubleshooting Common And Advanced Issues

Below are the issues merchants hit most, why they happen, and some important fixes:

1) Account Connection Fails (Can’t Activate PayPal In Shopify)

Why it happens: Store country and PayPal country do not match, PayPal email is unverified, Business/KYC not completed, or a legacy PayPal method is still enabled.

📌 Fix:

In Shopify Admin, open Settings, then Payments; remove any legacy PayPal method and try activation again. In the PayPal dashboard, verify the primary email, complete Business/KYC, and confirm the account country matches the Shopify store country.

If the account is personal, upgrade to Business (sole proprietors can choose “Sole Proprietor”).

2) Orders Stuck As “Pending” / Authorization Not Captured

Why it happens: Capture mode is Manual, but your team never captured; the authorization expired (time window lapsed).

📌 Fix:

In Shopify Admin, open Settings, then Payments, and set a capture policy: automatic for in-stock items; manual for preorders or custom items. For existing pending orders, open the order and capture now (full or partial). If the authorization expired, charge the customer again.

Keep in mind: Set an alert before authorization expiry and document partial-capture steps for split shipments.

3) Customer Cannot Pay With Card Through PayPal

Why it happens: Guest card payments are not allowed in PayPal for that region, PayPal risk blocks the card, or there is a browser/device issue.

📌 Fix:

In PayPal checkout settings, enable guest card payments where available. Ask the buyer to try another device or browser, or use your direct card gateway in Shopify.

4) Currency Mismatch Or Unexpected Totals

Why it happens: Multi-currency is used without Shopify Payments; the storefront currency is not supported by PayPal.

📌 Fix:

If you sell in multiple currencies, enable Shopify Payments so PayPal can present and refund in the shopper’s currency where supported.

If that is not possible, set the store currency to one PayPal supports or accept PayPal conversion and disclose this in help documents.

Also, document your foreign-exchange policy and test a cross-border order and partial refund each quarter.

5) Refunds Fail Or Are Delayed

Why it happens: Negative PayPal balance, no linked bank or backup card, refund path broken after a theme or app change.

📌 Fix:

Link and confirm a bank account in PayPal and add a backup card for instant refunds. Place a small live order and issue a partial refund after any checkout, theme, or app update.

Best Practices & Expert Tips for PayPal on Shopify

Let’s talk about some of the best practices that raise conversion, control payment risk, and keep finance/audit clean.

1) Set a Payment Capture Policy (Auto vs. Manual) and Tie It to Fulfillment SLAs

Start by deciding where authorizations become money in the bank. Auto-capture belongs with in-stock SKUs that ship on a tight SLA; manual capture belongs with preorders, backorders, and custom builds where timelines move.

Tie manual capture to the ship event, set alerts ahead of authorization expiry, and document partial-capture rules for split shipments.

The result is predictable cash flow, fewer expired auths, and a cleaner refund profile, thus setting the tone for everything that follows.

2) Enforce “Ship Only to the PayPal Address” With a Signature Threshold

Once the capture policy is clear, protect it with shipping discipline. Ship only to the PayPal-provided address, avoid mid-order edits (cancel and reorder if needed), and require signature over a defined AOV threshold.

This single discipline compresses “item not received” disputes, shortens resolution cycles, and gives your support team defensible evidence when cases do land.

3) Build a Dispute-Readiness & Resolution Workflow

With address and signature foundations set, build the evidence layer into the workflow rather than asking teams to scramble later.

Push carrier tracking on every order so it syncs to PayPal automatically. For example, use store pack-out photos for high-value goods and log activation/usage data for digital items.

Keep customer-facing policies aligned with support scripts, and respond inside the PayPal case thread to preserve a single audit trail.

Most cases are won at the moment of fulfillment, not in the Resolution Center.

4) Fund Refunds So Service Stays Fast and Negative Balances Never Stall You.

Disputes are rare when refunds are easy.

Maintain a minimum operating balance in PayPal or attach a backup card so instant refunds clear without friction.

Pair that with clear windows and conditions for returns and exchanges, and favor partial refunds when a line item is unavailable but the rest of the order should get shipped.

Finance, CX, and Ops should treat this approach as a single service promise.

5) Handle Currencies Deliberately: Use Shopify Payments for Clean Multi-Currency, Plan for FX When You Can’t.

Shopify passes the shopper’s currency through to PayPal (as long as PayPal supports that currency).

The price the customer sees on your site is the price they pay in their own currency, and refunds go back in that same currency.

This helps to reduce issues related to foreign exchange rates and customer complaints.

If this isn’t possible, be aware that PayPal will handle the currency conversion.

📌 Here’s what you need to do: Factor the exchange rate spread into your pricing, and clearly explain this in your help documentation so that your finance team doesn’t encounter these issues unexpectedly during support calls with customers.

| doola’s Quick Tip

A quick way to sanity-check your setup: pick one key market outside your store currency, place a small live order with PayPal, and process a partial refund. If prices and refunds show in the shopper’s currency without oddities, you’re in the “clean” (Shopify Payments) path. If you see conversion messages from PayPal, you’re in the FX path, price accordingly and document it. Sign up today! |

6) Keep Policies Current And Synchronized With How Support Actually Speaks

Refund, Shipping, Privacy, and Terms pages are part of your dispute stack. You need one source of truth (the policy page), one owner, and one update motion.

Set a quarterly review cadence, and any time a policy changes, push the exact wording into support macros, help-center articles, order-confirmation emails, and your returns/RMA portal the same day.

For example, if the policy says “30 days from delivery,” your macros must say “30 days from delivery,” not “30 days from purchase.”

Those phrases must appear on the policy page, in the returns portal, and in the email template customers receive. Agents should read from approved macros that mirror the policy verbatim, not from memory.

Train your support team for the tricky edge cases (late returns, partial refunds, damaged packaging) and give them the exact phrases that match the policy.

If an exception is granted, document it as a one-off, don’t let ad-hoc exceptions quietly rewrite your rules.

| doola’s Quick Tip

Version and date-stamp your policy pages, save screenshots when updates go live, and link those records inside your internal playbook. In a dispute, attach the live-at-the-time policy screenshot and the matching agent transcript. |

7) Reconcile PayPal As Its Own Processor Every Month. Tie It To Bookkeeping

Shopify doesn’t pay out your PayPal money, PayPal does. That means PayPal is its own payment processor in your books, with its own sales, fees, refunds, chargebacks, FX effects, and bank deposits.

Reconciliation means proving, on paper, that the cash PayPal sent to your bank matches what you should have received.

Start by setting up the right general-ledger structure. Use a PayPal Clearing (Asset) account to hold gross takings until they hit the bank.

Record fees in Payment Processing Fees (Expense), refunds in Refunds & Returns (Contra-Revenue), chargebacks in Chargebacks (Expense), and currency effects in FX Gain/Loss (Other Income/Expense).

This separation in your bookkeeping system keeps margin crystal clear and makes variance analysis possible.

8) Enable Two-Factor Authentication For PayPal, Shopify, And Your Accounting System

Security controls keep money, customer data, and financial records trustworthy.

They prevent unauthorized refunds or payouts, reduce fraud and chargebacks, protect access to Shopify/PayPal/accounting systems, and make month-end reconciliation defensible.

What to put in place to enhance the security of your PayPal account:

- Enforce 2FA on PayPal, Shopify, and the accounting system for all users.

- Use SSO/IdP where possible; disable accounts automatically on off-boarding.

- Apply least-privilege roles; separate refund permission from payout permission.

- Require dual control for sensitive actions (large refunds, bank changes, mass payouts).

- Ship only to the PayPal address; require signature above a defined AOV.

- Enable 3-D Secure/AVS where supported; block or review freight forwarders.

- Set manual-review triggers (first-time + high AOV, IP/country mismatch, velocity spikes).

- Maintain denylists/velocity limits and clear “say no” rules when risk signals stack.

- Use a password manager; block password reuse; mandate device encryption and updates.

- Store backup 2FA codes in the vault; rotate API keys on a schedule.

- Turn on security alerts (new device, password reset, role changes, large refunds).

- Quarterly access reviews across PayPal, Shopify, accounting; remove dormant users and tighten roles.

| Benefits Of Enabling 2FA ✔️ Enhanced Account Security: A stolen password isn’t enough, logins also need a one-time code from your authenticator app (TOTP) or a hardware/passkey, blocking most takeover attempts. ✔️ Reduced Risk Of Fraud: By stopping unauthorized logins, you cut off unauthorized refunds, payouts, and settings changes at the source. ✔️ Peace Of Mind: An extra layer on PayPal/Shopify/accounting keeps high-value refunds and payouts safer, less worry for you and your finance team. ✔️ Convenience And Control: Authenticator apps and passkeys are fast; you can enforce 2FA per user, store backup codes in your vault, and update methods without disrupting operations. Treat 2FA as a core financial control. It protects revenue, margins, and the audit trail that your monthly reconciliation relies on. |

How doola Can Help Shopify Merchants

doola helps e-commerce founders move from idea to first dollar in a U.S. business bank account, providing the formation, compliance, bookkeeping, taxes, and supporting services needed to operate confidently on Shopify (and Amazon).

What you get, end-to-end:

- Formation + EIN (no SSN required) so you can open a U.S. business bank account and start selling.

- doola Bookkeeping for invoicing, transaction categorization, Stripe fee pulls, payments, and expense tracking.

- doola Tax Filing to prepare and file returns for founders, freelancers, startups, and e-commerce sellers.

- Ongoing compliance (“business-in-a-box”) to keep your company in good standing.

Proof at scale: 10K+ founders, 1,000+ five-star reviews, across 175+ countries on 6 continents.

Sign up with doola today!

FAQs

Do I need a PayPal Business account to use PayPal with Shopify?

Yes. Shopify requires a PayPal Business account (personal accounts can’t accept ecommerce payments at scale). If you’re a solo seller, upgrade to Business → Sole Proprietor. No LLC needed.Verify your email and complete KYC (legal name/address, business details, owner ID).

- Link a bank for payouts and add a card as a refund backup.

- Ensure PayPal country = Shopify store country for activation.

- (Optional) Enable “PayPal account optional” for card-as-guest where eligible, add user roles, and turn on 2FA.

Fees are per transaction; no monthly fee for a Business account.

📌 Note: Shopify may charge extra transaction fees if Shopify Payments isn’t enabled, depending on your plan.

Can I use both Shopify Payments and PayPal at the same time?

Yes. Most stores run Shopify Payments and PayPal in parallel.

What are PayPal transaction fees on Shopify?

You pay PayPal’s own processing fees. Shopify may add extra transaction fees if Shopify Payments is not activated (varies by plan and region).

How do I allow customers to pay with credit cards via PayPal on Shopify?

Enable guest checkout in your PayPal Business account (Website Preferences → PayPal account optional: On). Availability depends on country/risk.

Why is my PayPal payment not showing in Shopify orders?

Check that PayPal is connected (Business, email verified, KYC complete), the store and PayPal countries match, and that you’re looking at the correct capture status (Authorized vs Paid). Remove legacy/duplicate PayPal methods.

Can I change my PayPal account after linking it to Shopify?

Yes. In Settings → Payments → PayPal, deactivate then connect the new Business account. Existing orders stay tied to the account that received the funds.

How do I handle refunds and disputes with PayPal on Shopify?

👉🏼 Refunds: The store owner or a staff member with refund permission issues refunds in Shopify → Admin → Orders → [Order] → Refund. PayPal then returns the money to the buyer’s original funding source. If you refund in PayPal instead, record the same refund in Shopify so records match.

👉🏼 Disputes: Use PayPal’s Resolution Center. For Item Not Received, submit carrier tracking (use signature above your AOV threshold). For Not as Described, submit photos, listing details, and your return steps. Ship only to the PayPal transaction address, respond within deadlines, and log the outcome for finance reconciliation.

News

Berita

News Flash

Blog

Technology

Sports

Sport

Football

Tips

Finance

Berita Terkini

Berita Terbaru

Berita Kekinian

News

Berita Terkini

Olahraga

Pasang Internet Myrepublic

Jasa Import China

Jasa Import Door to Door