You’ve set up your US business, started earning revenue, and everything’s going great..until tax season hits.

Suddenly, every tax jargon like Form 5472, ECI, and 1040-NR starts swirling around, and you’re left wondering: “How to file taxes as a non-US resident with a US business?”

You’re not alone. Many international founders form US businesses to access global markets but struggle to navigate the complexities of US taxation.

This guide breaks it all down, step-by-step, so you can stay compliant, avoid penalties, and focus on growth.

And here’s the best part: with doola, you don’t have to do it alone. From business formation to annual tax filings, doola helps non-US founders stay compliant and stress-free.

Understanding How US Taxes Work for Non-US Residents

Let’s start with the basics and then understand the bigger picture.

The US tax system distinguishes between US residents and non-residents.

If you don’t live in the US or don’t meet the IRS’s “substantial presence test” (which measures how many days you’ve physically spent in the US over the past three years) you’re officially considered a non-resident for tax purposes.

Here’s what that means for your business: You’re only taxed on your US-sourced income, specifically income that’s “effectively connected” with a US trade or business, commonly known as ECI (Effectively Connected Income).

Now taxes in the US operate across 3 main layers, and each can affect your business differently:

✔️ Federal Taxes

These are national taxes collected by the IRS and apply to income earned from US sources. Every business, regardless of state, falls under this umbrella if it earns taxable US income.

✔️ State Taxes

Each state has its own rules, rates, and filing requirements. Depending on where your business is registered or operates, you might owe state income tax, franchise tax, or annual filing fees, even if you don’t have a physical office in the US.

✔️ Local Taxes

In certain cities or counties, additional local taxes may apply. These are often smaller levies tied to operating within a specific municipality but are worth checking to avoid compliance gaps.

When you understand how these layers work together, you can map out your tax responsibilities clearly and avoid costly surprises during filing season.

🔖 Related Reading: How to File Business Taxes for the First Time: Step-by-Step Guide for New Entrepreneurs

Determine Your Business Type and Its Tax Obligations

Your US tax obligations don’t just depend on how much you earn, they depend on your entity type.

As a non-US founder, if you get your classification wrong, you risk double taxation, missed filings, or penalties down the road.

So, let’s break down your obligations clearly.

1. Single-Member LLC

If you’re the sole owner of a US LLC and not a US resident, the IRS treats your company as a “disregarded entity.” That means your business doesn’t pay taxes separately. Instead, the income “passes through” directly to you.

- Tax Filing Requirements: You’ll need to report your US-sourced income on Form 1040-NR (Nonresident Alien Income Tax Return).

- Additional Compliance: File Form 5472 (alongside a Pro Forma Form 1120) every year to disclose ownership and any financial transactions between you and your LLC, even if no money was made.

Example: Let’s say your LLC earned $60,000 from US clients in 2024 and there is no ECI with the US trade or business. You’d need to report this income on Form proforma 1120 and 5472 to stay compliant.

2. Multi-Member LLC

If your business has two or more members (even if both are non-US residents), the IRS sees it as a partnership by default. The LLC doesn’t pay taxes directly. Instead, profits and losses are passed through to each partner.

Tax Filing Requirements: File Form 1065 (US Return of Partnership Income) to report the company’s income. Then, issue Forms k-1 to each partner, showing how much income they earned.

So, suppose your LLC made $120,000 in US income split between two partners. Each would report $60,000 on their respective filings.

✅ Why It Matters: Even if you made no profit, you still must file Form 1065 annually to remain compliant and maintain good IRS standing.

3. C-Corporation

A C-Corp is considered a separate legal and taxable entity, meaning the company itself pays taxes, not you (at least not initially).

- Tax Filing Requirements: File Form 1120 (US Corporation Income Tax Return) annually. The corporation pays a flat 21% federal tax rate on its net income.

- Shareholder Taxes: When profits are distributed as dividends, they’re taxed again at the shareholder level; this is where you may face double taxation.

Example: If your C-Corp earns $100,000 in profit, it owes $21,000 in federal taxes. If you withdraw $50,000 as dividends, you’ll be taxed on that amount personally (often between 15–30%, depending on tax treaties).

| ⚡ doola Tip for Non-US Founders

Many foreign founders use C-Corps for scalability, funding, and investor credibility, but careful planning helps you reduce unnecessary tax burdens. |

Each structure impacts your tax liability and compliance requirements differently: how you’re taxed, what forms you must file, and how your profits are distributed. So choose wisely and keep your records clean.

With doola, you don’t have to decode it all alone. From choosing your entity type to filing every required form on time, doola ensures your business stays compliant while you focus on growth.

Sign up to know more about our services.

Identify Which US Tax Forms You Must File

Each business entity, from a single-member LLC to a C-Corp, faces its own set of reporting duties. Overlook one form, and your business could face penalties or processing delays.

Here’s your cheat sheet to the most important IRS forms for non-US founders:

| Form | Who Must File | Purpose |

| Form 5472 + Pro Forma 1120 | Single-member LLC owned by a foreigner | Report ownership and transactions between the LLC and its owner |

| Form 1065 | Multi-member LLC | Report partnership income and distributions |

| Form 1120 | C-Corp | Corporate income tax return |

| Form 1040-NR | Non-resident individuals | Report US-sourced income |

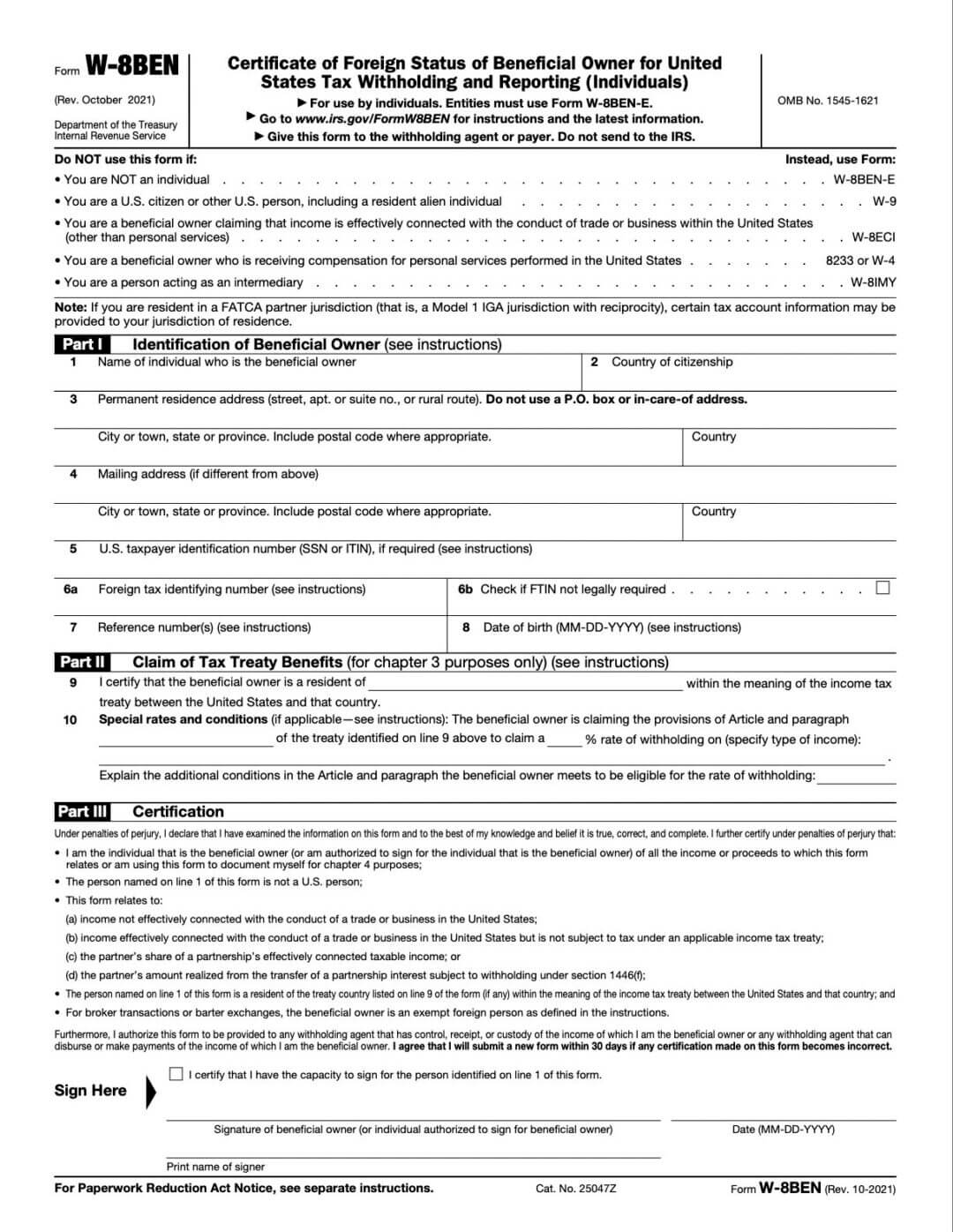

| W-8BEN / W-8BEN-E | Foreign individuals or entities | Certify foreign status and claim tax treaty benefits |

| Forms 8804 / 8805 | Partnerships | Report and withhold taxes on foreign partners’ income |

Missing any of these can trigger hefty penalties, especially Form 5472, which carries a $25,000 fine for non-compliance.

How to File Your US Business Taxes Step-by-Step in 2025

If you’re operating across the globe, US taxes can feel a bit complex, and we totally get it. But once you break the process down into manageable steps, filing taxes as a non-US founder becomes far less challenging.

Here’s how to make your tax season painless and penalty-free:

Step 1: Gather Your Financial Records

Before you touch a tax form, you’ll need to get your finances in order. So, make sure your collect the following documents:

- Income statements: All revenue earned from clients or operations.

- Expense receipts: Everything from software subscriptions and contractor payments to travel expenses related to US business activities.

- Invoices & bank statements: These serve as proof of income and deductible expenses.

Example: If your US LLC made $50,000 in sales and spent $15,000 on expenses (marketing, software tools, etc.), your net taxable income would be $35,000; that’s the amount the IRS cares about. So make sure you have the supporting documentation ready.

Step 2: Determine Your Entity’s Filing Requirement

Your business structure decides which forms you file and how income is taxed:

| Entity Type | Tax Treatment | IRS Form(s) | Who Pays the Tax? |

| Single-Member LLC (Foreign-Owned) | Disregarded entity | Form 5472 + Pro Forma 1120 | Owner |

| Multi-Member LLC | Partnership | Form 1065 + 8804/8805 | Each partner reports their share |

| C-Corp | Separate entity | Form 1120 | Corporation pays corporate tax |

📌 Example: If you own a single-member LLC, you’ll likely file Form 5472 (to report foreign ownership)

A multi-member LLC splits its income among members based on ownership share. For instance, if your LLC earns $60,000 and you own 60%, you’ll report $36,000 on your own return.

Step 3: Prepare & File the Relevant IRS Forms

Now that you know what applies to your entity, it’s time to complete and file your IRS forms.

- Form 5472 + Pro Forma 1120: For foreign-owned single-member LLCs.

- Form 1065: For multi-member LLCs to report total partnership income.

- Form 1120: For C-Corps, used to calculate and pay corporate income tax.

Most forms can be e-filed directly through the IRS or submitted via an authorized tax service. Make sure to double-check the deadlines (see next section) because late filings can trigger penalties starting at $25,000 per form for non-compliance.

Step 4: Check for State-Level Obligations

Even if your business is fully online or based abroad, your state of registration may still require annual reports or taxes. For example:

- Delaware requires an annual report and a $300 franchise tax for LLCs.

- Wyoming charges an annual license tax based on assets located in the state.

- Florida imposes a corporate income tax on C-Corps with US-based operations.

Always verify your state’s specific rules. doola’s team helps you track these automatically so you never miss a deadline.

🔖 Related Reading: Delaware Franchise Tax: What You Need To Know

Step 5: Keep Everything on File

Once you’ve filed, don’t lose track of your records (both digital and physical). Keep copies of all tax forms, receipts, invoices, and correspondence for at least five years.

Because if the IRS ever audits past years’ returns, proper documentation and record-keeping would be your best defense. Consider using trusted tools like doola Bookkeeping to store and organize everything securely.

Also, with doola’s compliance tools, you can automate your filings, track due dates, and ensure every form, from your 5472 to your annual state report, is submitted on time.

Key US Tax Deadlines for Non-US Residents

Look, here’s the truth: the IRS doesn’t care where you live; if you own a US business, your filing deadlines apply just like any US founder’s.

Now mark your 2025 tax calendar right away:

| Date | Entity Type | Forms Due | What It Means |

| 📅 March 15, 2025 | Partnerships (Multi-member LLCs) | Form 1065, Forms 8804 & 8805 | Partnerships must file their annual return and issue Schedule K-1 to each foreign partner to report income shares and withholdings. |

| 📅 April 15, 2025 | C-Corporations | Form 1120 | Corporations report and pay corporate income tax at a 21% flat rate on all US-sourced profits. Extensions available with Form 7004. |

| 📅 April 15, 2025 | Single-member LLCs (foreign-owned) | Form 5472 + Pro Forma Form 1120 | Required for every foreign-owned single-member LLC, even if it made no income. Skipping it can trigger a $25,000 penalty. |

🕒 Missed a deadline?

Don’t panic, but don’t delay either. Late filings can result in penalties, interest accruals, and potential loss of treaty benefits. The IRS allows extensions (usually up to six months) if you submit Form 7004 before your due date.

⚡Tip: If keeping track of multiple deadlines sounds like a nightmare, doola’s compliance dashboard does it for you. You’ll get automated reminders, deadline tracking, and expert filing support, so you never miss a date (or a deduction).

Common Mistakes Non-US Business Owners Should Avoid

Slip-ups related to tax filing may seem harmless at first, but they can quickly snowball into costly penalties, compliance headaches, or even business suspension.

Let’s break down the most common mistakes founders make, their impact, and how to keep your business safe from them.

❌ Skipping Form 5472

The IRS treats this as a serious offense for foreign-owned single-member LLCs. Missing or incorrectly filing it can trigger a $25,000 penalty, with additional fines stacking up for continued non-compliance.

Solution: Always file Form 5472 along with a pro forma Form 1120 each year, even if your LLC made no income. Platforms like doola make this process effortless by automatically generating and submitting the required filings on your behalf.

❌ Assuming “No Income = No Filing”

Many non-resident founders assume that if their LLC hasn’t earned a dime, there’s nothing to report. Unfortunately, that’s not how the IRS sees it. Failure to file can lead to compliance issues, penalties, and delays when opening US bank accounts or raising funds.

Solution: File the necessary IRS forms regardless of income. Even “zero-activity” reports signal that your business is compliant and active.

❌ Mixing Personal & Business Finances

Blurring these lines jeopardizes your LLC’s liability protection and can complicate your bookkeeping or trigger IRS audits.

Solution: Maintain separate business bank accounts and track every transaction through a dedicated system like doola Bookkeeping, which keeps your records clean, audit-proof, and ready for tax season.

❌ Forgetting State Compliance Requirements

Each state has its own filing rules, fees, and deadlines. Missing your Delaware franchise tax, Wyoming annual report, or California statement of information can lead to fines or administrative dissolution.

Solution: Mark all state filing dates in your compliance calendar or let doola’s automated alerts handle it for you, so you never miss a deadline again.

❌ Not Maintaining a US EIN or Registered Agent

Without an Employer Identification Number (EIN) or active registered agent, your LLC isn’t officially recognized for tax or legal purposes. This can freeze your ability to open a US bank account or file taxes.

Solution: Apply for an EIN immediately after formation and keep your registered agent active year-round. If you’re using doola’s services, both are included and managed for you from day one.

🔖 Related Reading: How to Double-Check and Review Completed IRS Tax Returns for Errors in 2025

How to Avoid Double Taxation in 2025

Paying taxes once hurts enough; but paying them twice on the same income? That’s a living nightmare, so let’s get it sorted for good.

Fortunately, the US tax system has a built-in safeguard for foreign entrepreneurs through Double Taxation Agreements (DTAs), treaties the US has signed with more than 60 countries around the world.

These treaties are designed to prevent you from being taxed by both the US and your home country on the exact same income.

Here’s how these treaties protect your bottom line and how you can use them to your advantage:

1. Avoid Being Taxed on the Same Income Twice

A DTA determines which country has the right to tax your income, depending on where it was earned and where you reside.

For instance, suppose you’re a German entrepreneur running a US-registered LLC engaged in a U.S. trade or business. You earn $80,000 in profit from US clients. Without a tax treaty, you might owe US income tax and German income tax on the same $80,000.

But thanks to the US-Germany tax treaty, your home country typically grants a foreign tax credit, allowing you to subtract what you paid in US taxes from what you owe in Germany.

2. Claim Reduced Withholding Rates Using Form W-8BEN

The Form W-8BEN (for individuals) and W-8BEN-E (for entities) are essential tools for claiming treaty benefits.

When a US company pays a foreign person or business, it’s required to withhold 30% of the payment for taxes, unless a tax treaty specifies a lower rate.

For example, imagine your US LLC pays you, a resident of the UK, a $10,000 dividend.

- Without a treaty: The US company must withhold $3,000 (30%) in taxes.

- With the US-UK treaty in place: The withholding rate may drop to 5% or 15%, depending on the type of income, meaning you’d owe just $500–$1,500 instead.

By simply filling out and submitting Form W-8BEN, you certify your foreign status and claim the treaty rate that applies to your country. That’s thousands of dollars saved, and perfectly legal under IRS rules.

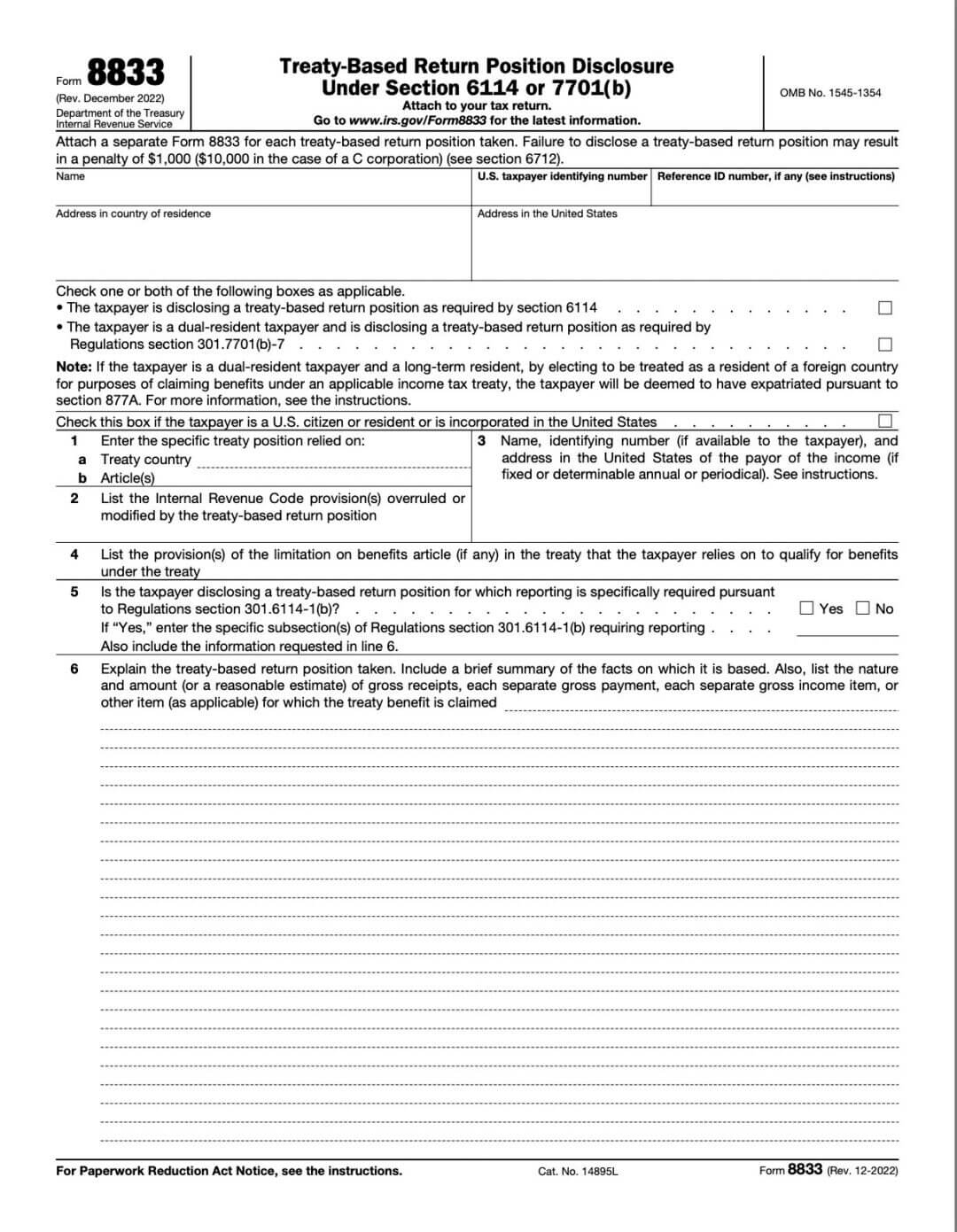

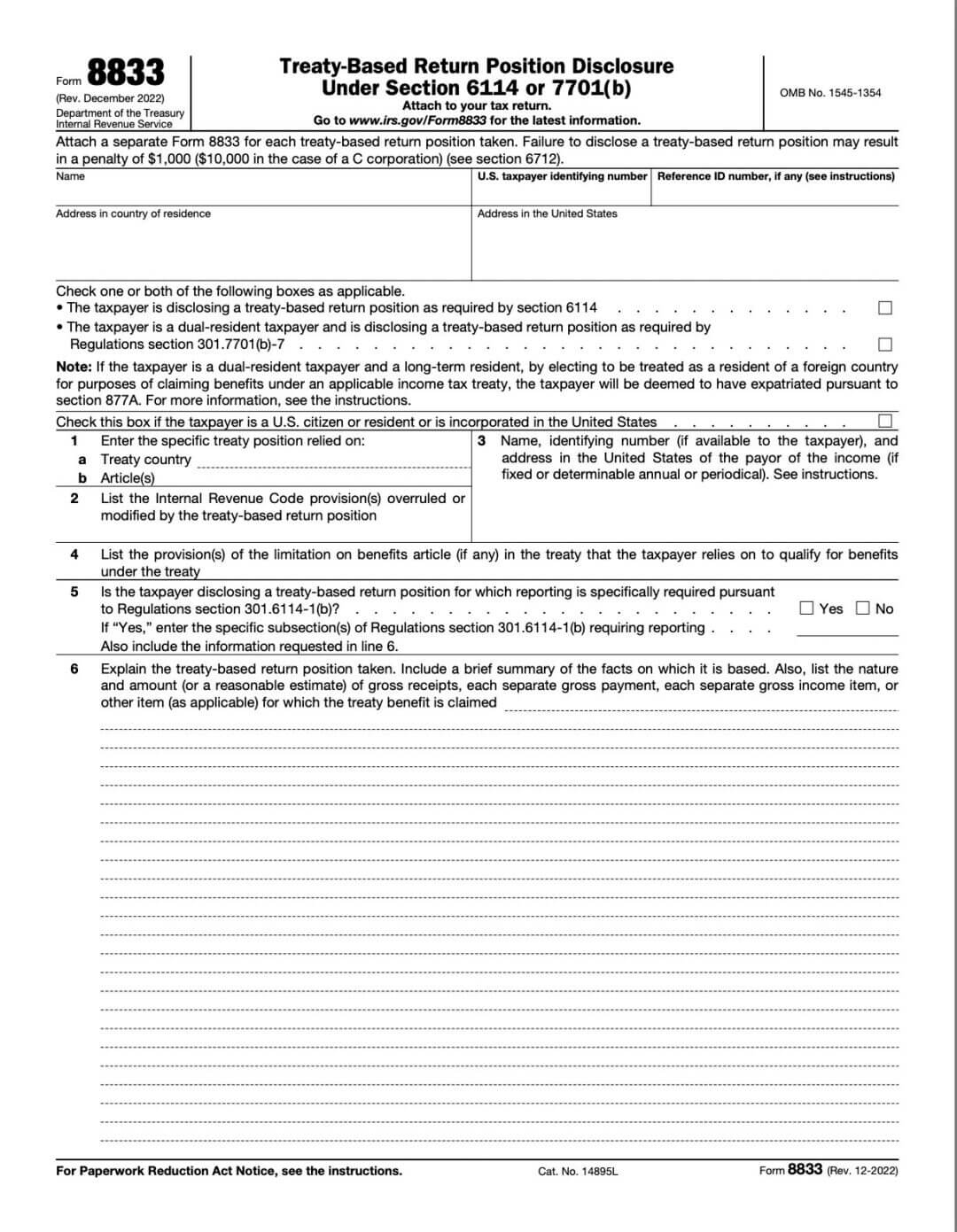

3. File Correctly and Strategically to Maximize Treaty Benefits

Filing under a tax treaty isn’t automatic; you need to actively claim your benefits through the right forms and documentation. For example:

- If you’re a non-resident individual, attach Form 8833 (Treaty-Based Return Position Disclosure) to your Form 1040-NR to officially claim treaty protection.

- If your business is an LLC or C-Corp, ensure your accountant properly reflects treaty-based exemptions when filing Form 1120 or Form 5472.

Even a small clerical mistake, like forgetting to submit W-8BEN or missing Form 8833, can nullify your treaty benefits and result in overpayment or penalties.

That’s where doola steps in: our experts know the ins and outs of international filing and ensure every treaty claim is executed properly, so you only pay what you truly owe, nothing more.

How doola Helps Non-US Founders Stay Tax Compliant

Filing US taxes as a non-US resident may sound challenging, but with the right guidance and the right partner, it’s seamless and stress-free.

And with a partner like doola, you get a one-stop solution for formation, compliance, and financial management. Here’s how doola keeps your business future-ready:

🚀 Form your US business

🚀 Get your EIN fast, with guided support to avoid delays

🚀 Stay compliant year-round with automatic filings for Forms 5472, 1120, and 1065

🚀 Simplify your finances with built-in bookkeeping and sales tax support

With doola by your side, you’re not just avoiding penalties; you’re building a borderless business that’s compliant, credible, and ready to grow.

So whether you’re a global founder managing clients across time zones or expanding your startup into the US, doola ensures your company stays compliant and ahead of every deadline.

Sign up with doola today, and make every tax season your easiest one yet.

FAQs

Can I file my US taxes without a Social Security Number (SSN)?

Yes. You can use an ITIN (Individual Taxpayer Identification Number) instead.

What happens if I don’t file Form 5472 for my foreign-owned LLC?

You may face a $25,000 penalty and additional fines for continued non-compliance.

Do I need to file state taxes if my LLC has no US address or employees?

It depends on the state where your LLC is registered. Some require annual reports or franchise taxes even without physical operations.

Can I claim deductions as a non-resident business owner?

Yes, ordinary and necessary business expenses are deductible against income.

What’s the difference between an EIN and ITIN, and do I need both?

An EIN identifies your business; an ITIN identifies you as an individual for tax purposes. You may need both.

Can doola handle both my company formation and annual tax filings?

Absolutely. From setting up your business to filing your annual reports and taxes, doola handles it all.

Agen234

Agen234

Agen234

Berita Terkini

Artikel Terbaru

Berita Terbaru

Penerbangan

Berita Politik

Berita Politik

Software

Software Download

Download Aplikasi

Berita Terkini

News

Jasa PBN

Jasa Artikel

News

Breaking News

Berita