If your partnership includes foreign investors, Form 8805 is the proof of tax withheld on each partner’s share of U.S. business income, effectively connected taxable income (ECTI).

Your foreign partners use it to claim a credit on their U.S. return; without it, the IRS can’t match the withholding, so no credit or refund.

Even if you have an in-house tax team to guide about different tax forms, there are a few 8805 essentials you’ll want at your fingertips.

In this guide, we’ll cover who is required to file Form 8805, what goes on it, how it differs from Form 8804, the key dates (including quarterly vouchers via Form 8813), the penalties to watch, and how foreign partners can use it to claim refunds or avoid double taxation.

Ready? Let’s get started.

What Is Form 8805?

Form 8805 is the annual statement a partnership gives each foreign partner showing that Section 1446 tax was withheld on that partner’s share of effectively connected taxable income (ECTI).

The foreign partner attaches it to their US return to claim the credit.

Who Must File Form 8805?

Every U.S. partnership with effectively connected gross income must prepare and file Form 8805 for each partner on whose behalf it paid Section 1446 tax.

This includes:

- LLCs taxed as partnerships

- Publicly traded partnerships (PTPs)

Even if no withholding tax was due (say the partnership had losses), you may still need to file Form 8805 if the foreign partner had ECTI allocated.

Example: If the partnership had $10,000 ECTI and allocated $2,000 to a foreign partner, an 8805 must be filed, even if losses offset the income elsewhere.

Generally, file form 8805 on or before the 15th day of the 3rd month following the close of the partnership’s tax year.

For partnerships that keep their records and books of account outside the United States and Puerto Rico, the due date is the 15th day of the 6th month following the close of the partnership’s tax year.

You can file Form 7004 to request an extension of time to file Form 8804.

📌 Note: Filing a Form 7004 doesn’t extend the time for payment of tax.

Exceptions & Exemptions (and the Documentation You Need)

Even if a partnership would generally issue Form 8805, a few carve-outs and special regimes change what gets filed and which forms prove status or reduce withholding.

Here are those special exceptions and exemptions:

👉🏼 Treaties can affect how much U.S. tax a partner pays. If a partnership properly documents this on Form 8804-C, they can reduce the amount of tax withheld.

If not, the partner can claim the difference as a credit on their tax return (Form 1040-NR or 1120-F) using Form 8805.

Documentation to keep: 8804-C (treaty impact), plus the partner’s W-8BEN/E for treaty status in other regimes; attach 8804-C to the IRS copy of Form 8805 if you used it to reduce withholding.

👉🏼 The Form 8804/8805 return/statement requirement applies to “every partnership other than a PTP” with effectively connected gross income allocable to foreign partners. This means, most PTPs don’t file 8804/8805.

PTPs follow special §1446 rules, typically withholding on distributions and reporting to investors on Form 1042-S (not Form 8805). Brokers also handle 10% §1446(f) withholding on transfers of PTP interests, with exceptions if proper certifications are provided.

Documentation to keep: Investor W-8/W-9s and broker/withholding certifications under §1446(f).

Talk to our experts to know more about such exemptions and exceptions.

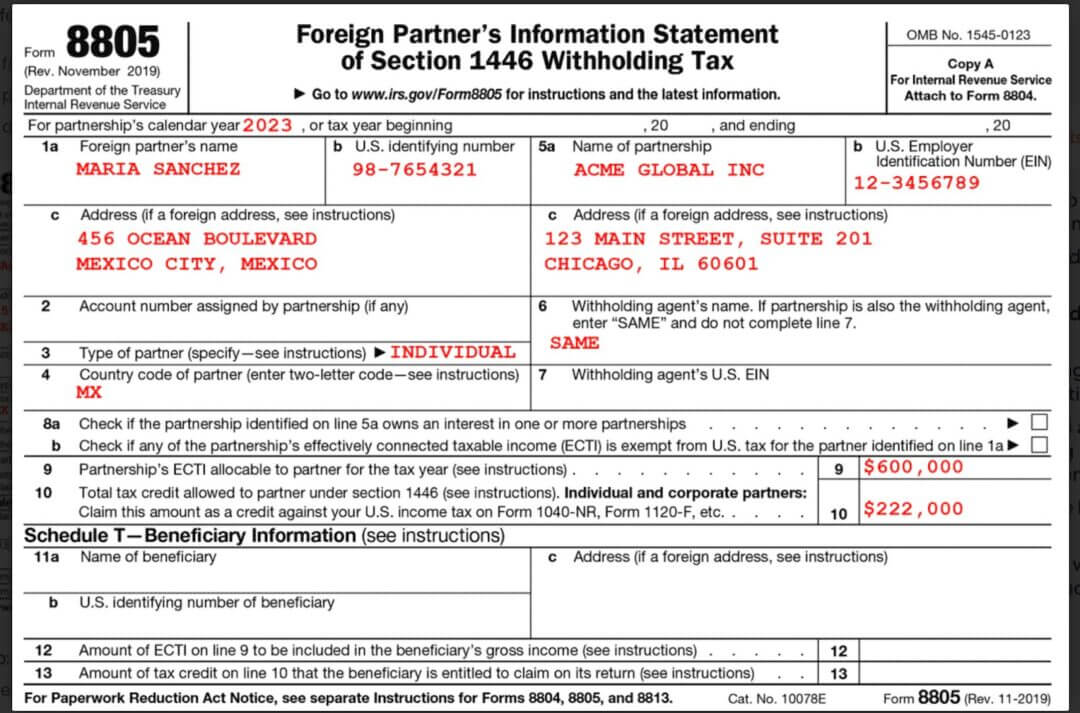

Key Information Reported on Form 8805

Key information required on Form 8805 includes:

- The foreign partner’s name, address, and identification number

- The partner’s share of ECTI

- The amount of tax withheld on the partner’s behalf under Section 1446

Keep in mind: You need to prepare a separate Form 8805 for every foreign partner and file it along with Form 8804, even if no tax was withheld. One copy goes to the IRS, and another must be given to the partner.

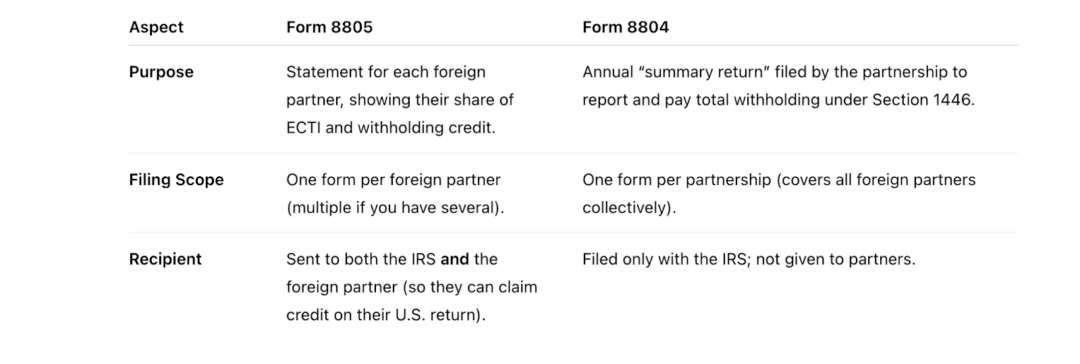

Form 8805 vs. Form 8804: What’s the Difference?

Here’s a clear side-by-side comparison table with the three biggest differences between Form 8805 and Form 8804:

After you’ve seen the Form 8805 vs. Form 8804 comparison, there’s still one piece missing: how the money actually moves during the year. That’s where Form 8813 fits in.

- Form 8804 is the partnership’s annual tax return for withholding.

- Form 8805 is the slip each foreign partner gets to claim their credit.

But neither of those forms actually transmits money to the IRS.

Form 8813 is your quarterly payment voucher. Which means, each quarter, the partnership pays Section 1446 withholding to the IRS using Form 8813 vouchers.

Filing Requirements, Deadlines & Penalties

Let’s learn more about form 8805’s filing requirements, deadline and penalties in detail:

Filing Requirements:

Here’s what you actually have to do:

One 8805 per foreign partner. So, if you have five foreign partners? Five 8805s.

What goes on it: the partner’s details (name/address/TIN), their share of ECTI, and the withholding you took under §1446.

Where it goes: To the IRS. You need to submit all the 8805s with your Form 8804 (the partnership’s annual summary).

| How to submit (paper vs. electronic)Paper filing address (for 8804, 8805, 8813):

Internal Revenue Service Center P.O. Box 409101. Ogden, UT 84409. Electronic options: support varies by software. Many practitioners still paper-file 8804/8805 separately from Form 1065; some suites don’t e-file these forms. Check your provider; if they don’t support e-file for 8804/8805, mail to Ogden. Paying electronically: you can send the cash via EFTPS instead of mailing the 8813 check, but you still must file the forms. Source |

Filing Deadlines

The filing date for Forms 8804 and 8805 is tied to your tax year: they’re due by the 15th day of the fourth month after year-end. If you’re on a standard calendar year, circle April 15 as your deadline.

For partnerships that keep their records and books of account outside the United States and Puerto Rico, the due date is the 15th day of the 6th month following the close of the partnership’s tax year.

Beyond filing, partnerships must make periodic payments during the year using Form 8813. These installments are applied against the total withholding tax reported on Form 8804 at year-end.

Late Filing / Extensions (Form 7004)

You may request an extension to file by submitting Form 7004 before the original due date. This grants an additional six months to file Forms 8804 and 8805 and avoids late-filing penalties, but it does not extend the time to pay, so IRS late-payment penalties may still apply.

Penalties

Here’s what happens if you miss your Form 8805 filing or withhold incorrectly

- Form 8805 ( late/incorrect filing with the IRS): A per-form penalty (commonly referenced around $290 each, up to an annual cap, e.g., $3,532,500). Remember: it’s one 8805 per foreign partner, so this multiplies quickly.

- Form 8805 ( failure to furnish to the partner): A separate per-form penalty (again, often around $290 each, with a similar annual maximum).

Practically: you can be penalized twice on the same partner, once for the IRS copy, once for the partner copy.

- Form 8805 (Late payment penalty): The penalty for late tax payments is 0.05% of the unpaid tax for each month or part of a month the payment is late. This is capped at 25% of the unpaid tax.

Quick tip: Penalty dollar amounts change with inflation and can vary with how quickly you correct errors. Always check the latest IRS inflation adjustment and the current Instructions for Forms 8804/8805/8813 before you publish numbers.

How Foreign Partners Use Form 8805

As mentioned earlier, form 8805 acts like a tax receipt. It shows how much U.S. income was allocated to the foreign partner and how much tax the partnership already withheld on their behalf.

Here’s how the foreign partner uses it:

On Their US Tax Return

Individuals attach Form 8805 to Form 1040-NR. Foreign corporations attach Form 8805 to Form 1120-F. The withholding shown on Form 8805 becomes a credit against their final U.S. tax bill.

For Refunds

If too much tax was withheld, the partner claims a refund. Without Form 8805, the IRS won’t issue credit or refund.

To Prevent Double Taxation

In many countries, partners can claim a foreign tax credit for U.S. tax paid. Form 8805 often serves as proof for their home-country tax authority.

For Recordkeeping

Partners keep copies to back up their U.S. return and support tax filings abroad.

In short: without Form 8805, a foreign partner cannot prove withholding, cannot claim credits, and may face double taxation.

| Application Process For Filing Form 8805

1. Gather The Required Information: Collect partner details (name, address, TIN), their share of Effectively Connected Taxable Income (ECTI), and the tax withheld. 2. Prepare One Form Per Partner: Complete a separate Form 8805 for each foreign partner, even if no withholding was applied. 3. Attach To Form 8804: File Form 8804 as the annual summary and attach all the completed 8805s. 4. Furnish Copies To Partners: Provide each foreign partner with their copy of Form 8805 so they can use it for their U.S. filing. 5. File With The IRS By Mail: Electronically: Some software supports e-filing, but many partnerships still mail paper forms. 6. Meet The Deadline: Due on the 15th day of the 4th month after the partnership’s year-end (April 15 for calendar-year filers). File Form 7004 before the deadline if you need an extension to file (but not to pay). 7. Make Quarterly Payments With Form 8813: During the year, use Form 8813 (or EFTPS) to send in withholding. These payments are reconciled when you file 8804 and 8805. Talk to our tax experts to know more! |

Common Challenges & Frequent Mistakes With Form 8805

Here are a few common challenges and mistakes that arise when filing Form 8805:

Misallocating Income

Partnerships often struggle to calculate each foreign partner’s exact share of Effectively Connected Taxable Income (ECTI). A small error here cascades into wrong withholding and incorrect 8805 reporting.

Missing Or Incorrect Partner Information

Forms filed with the wrong taxpayer identification number (TIN/ITIN/EIN), outdated addresses, or incomplete partner details can be rejected or penalized.

Late Filing Or Furnishing

Partnerships sometimes file Form 8805 with the IRS but forget to send copies to partners on time. Both lapses carry separate penalties.

Not Reconciling With Quarterly Payments

The amounts paid during the year on Form 8813 vouchers don’t always match the totals reported on Form 8804 and attached 8805s. This mismatch can trigger IRS notices and delay partner credits.

Underestimating Treaty Impact

Partnerships may overlook applicable tax treaty benefits that could lower withholding. That means either over-withholding (leading to refund hassles for partners) or failing to apply the treaty correctly (risking penalties).

| doola’s Prevention Checklist As a founder, you don’t need to memorize every IRS line number. You just need to know where things usually go wrong and how to stop them before they hit your investors or your inbox. After walking through the five most common pitfalls with Form 8805, the next step is about control: how to build a simple, repeatable system that keeps filings accurate, partners happy, and penalties off your plate. That’s where doola’s Prevention Checklist comes in. It’s the exact best practices we use with global founders to make sure quarterly payments, partner allocations, and treaty claims line up cleanly year after year. ✅ Verify Allocations Early Run a quarterly review of each partner’s share of ECTI so withholding and 8805 numbers stay accurate. ✅ Keep Partner Records Updated Maintain a live database of partner names, addresses, and TIN/ITIN/EINs. Double-check before filing to prevent rejections. ✅ Sync Filing And Furnishing Deadlines ✅ Reconcile Payments And Reports Match every 8813 quarterly payment against year-end totals in 8804 and 8805. Keep a paper/electronic trail for audit readiness. ✅ Review Treaty Positions |

How doola Can Help With Form 8805 & US Taxes

If your partnership has ECTI, Forms 8804 and 8805 aren’t optional, they’re the backbone of Section 1446 compliance.

They make sure each foreign partner pays U.S. tax on their share of effectively connected income, and they give partners the documentation they need to claim credits without any hassles.

But, navigating these filing requirements can be challenging, especially for partnerships with complex structures. Think changing ownership, special allocations, treaty rates, and quarterly payments that must reconcile at year-end.

doola makes it easy for you.

Our team has years of international tax experience and has prepared hundreds of returns like yours. We guide the process end to end, so filings are accurate and on time, thus reducing penalty risk and giving you complete peace of mind during tax season.

Sign up for a demo with doola for a smooth filing experience.

FAQs

What happens if a foreign partner doesn’t receive Form 8805?

Ask the partnership (or its tax preparer) to furnish it ASAP, it’s their obligation.

You can still file your U.S. return (Form 1040-NR or 1120-F) using your K-1 and books, but you’ll need Form 8805 (or equivalent proof) to claim the credit for any Section 1446 withholding.

If it arrives after you file, you can amend to claim the credit.

Can a foreign partner file U.S. taxes without Form 8805?

Yes. Filing is still required if you have effectively connected income (ECI). However, you can’t claim/refund 1446 withholding without the 8805 (or convincing alternative evidence).

Practically: file/extend on time, keep chasing the partnership for the form, and amend if needed.

Is Form 8805 required even if the partnership made a loss?

Generally, no 8805 is required if there’s no ECI and no 1446 withholding. The partner will still get a Schedule K-1 showing the loss.

If there was prior-year overwithholding being applied, or special 1446(f) situations, talk to the preparer, as edge cases exist.

How do I claim tax treaty benefits with Form 8805?

Treaties usually don’t reduce 1446(a) withholding on ECI at the partnership level. Instead, the partner claims treaty benefits (and regular deductions) on the annual return, and uses the 8805 as a refundable credit against final tax.

For non-ECI items covered by treaties (e.g., interest/dividends under §1441), provide the right W-8 and handle those separately.

What’s the difference between withholding under Section 1441 and 1446?

- Section 1441: Withholding on FDAP income (fixed/periodic—interest, dividends, royalties) to foreign persons, typically 30% unless reduced by treaty. Reported on Form 1042-S.

- Section1446: Withholding on a foreign partner’s share of ECI from a partnership. Withheld at the highest applicable rate (individual top rate or corporate rate) and reported to the partner on Form 8805 (and to the IRS via Form 8804).

Does every foreign partner get a separate Form 8805?

Yes. Each foreign partner gets their own 8805 for the year from each withholding partnership they’re in. If you were in multiple partnerships (or tiers), you’ll receive one from each.

Can doola help file both partnership forms (8804, 8805) and foreign partner returns?

Absolutely. We can prepare Forms 8804/8805 for the partnership and handle foreign partner returns (1040-NR / 1120-F), reconcile credits, and manage treaty positions, end-to-end, on time, and with clean backup.

News

Berita

News Flash

Blog

Technology

Sports

Sport

Football

Tips

Finance

Berita Terkini

Berita Terbaru

Berita Kekinian

News

Berita Terkini

Olahraga

Pasang Internet Myrepublic

Jasa Import China

Jasa Import Door to Door